Indonesia has the potential for venture capital investment due to the growth of the internet-based economy. However, the amount of venture capital investment in Indonesia and other Southeast Asia nations is still low.

Venture capital can be defined as a type of financing which investors provide to a startup. In the startup industry, venture capital plays an important role as a source of funding, as a result, venture capital investment can support the startup ecosystem.

Venture capital investment is increasing across Asia. It is due to the growth of the number of startups and the tech-savvy broad market in the Asia region.

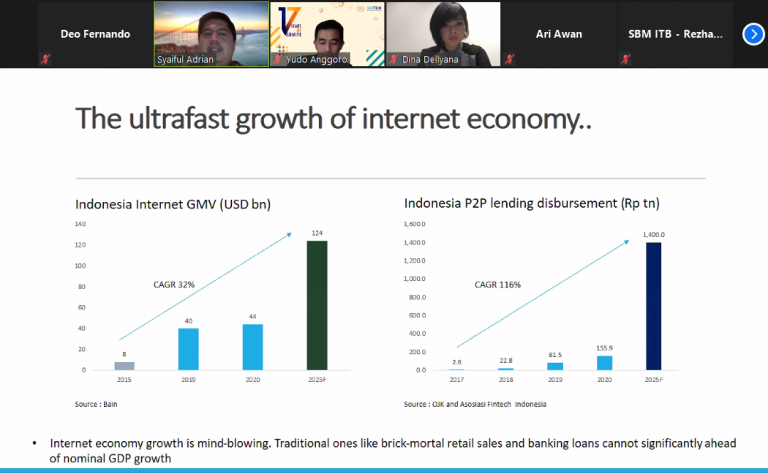

President Director of PT Kredit Rating Indonesia Syaiful Adrian said that the internet-based economy in Indonesia is extraordinary already. Therefore, Indonesia has potential for venture capital investment due to the growth of the internet-based economy. He said that in the Etalk webinar that was organized by SBM ITB through MBA Jakarta Campus, Thursday, (4/3/2021). Another speaker was the Managing Director of Sinar Mas Digital Ventures (SMDV) Ari Awan.

However, the amount of venture capital investment in Indonesia and other Southeast Asia nations is still low. China became the top one of venture capital investment by getting $ 15.007 in 2019 and then India for the second place. On the other side, Southeast Asia only gained around $ 3.500 in 2019 of venture capital investment.

“China currently became the number one and then India the second. Despite the low venture capital investment in South East Asia, the growth was bigger than China and India,” he added.

He argued that the acceptance of people in South East Asia toward the internet is fast. So, he believed that in several years ahead, the venture capital investment in southeast Asia will bypass India.

Furthermore, Syaiful said, if we talked about the southeast Asia region, Singapore became the first and then Indonesia in the second place. Based on the research conducted by DealStreetAsia, Singapore managed to get two billion dollars of venture capital investment in 2019, while Indonesia only collected 0.6 billion dollars of venture capital investment. Indonesia was supposed to get larger venture capital investment than Singapore.

“Indonesia’s GDP is 3x larger than Singapore’s. Nevertheless, Singapore’s Venture capital investment is 3x larger than Indonesia,” he said.

According to Ari Awan, there are some problems in Indonesia’s venture capital regulation. Ari thought that besides Indonesia having a potential market and good internet penetration, some crucial problems need to be fixed such as tax, regulation, and the urgency to establish legal fund entities.