Highlight

The transportation sector dominates the national energy consumption at 45 percent. Based on data from the Central Statistics Agency (BPS, 2019), in a period of five years, namely 2013-2018, the increase in the number of motorcycles increased by 41 percent from 104,118,969 units to 146,858,760 units or an average increase of 8 percent each year. Consumption of fuel oil also continues to increase, but the capacity of fuel refineries does not increase. The development of a battery-electric vehicle (BEV) that is energy efficient is a solution for:

- Reducing the use of fuel in the transportation sector to improve energy efficiency,

- Sustainability of national energy security,

- Energy conservation in the transportation sector, as well

- The realization of clean energy, clean air quality, and environmentally friendly.

The Adoption of BEV in Indonesia

The central government policy regarding the national-level energy management plan in the National Energy Policy (KEN) explains the results of modeling between energy supply-demand until 2050, the policies and strategies undertaken to achieve these targets.

To achieve national energy security, priorities for developing energy are based on:

- Optimizing the consumption of renewable energy by taking into account the economic level,

- The need to reduce petroleum consumption because consumption is more significant than production. On the other hand, the national petroleum resources are getting depleted from time to time. The program to reduce petroleum consumption will reduce imports, thereby reducing the burden on the state budget. In the period 2004-2015, energy subsidies reached IDR 2,182 Trillion,

- Optimization of natural gas consumption

BEV implementation in Indonesia is still in its early stages. The Presidential Regulation number 55 the year 2019 about the acceleration of the BEV program for road transportation, enacted on 8 August 2019, is a concrete manifestation of the central government’s commitment to providing direction, foundation, legal certainty. It also encourages the acceleration of the BEV program, encouraging mastery of industrial technology and vehicle design so that it will be able to make Indonesia a production and export base for BEVs.

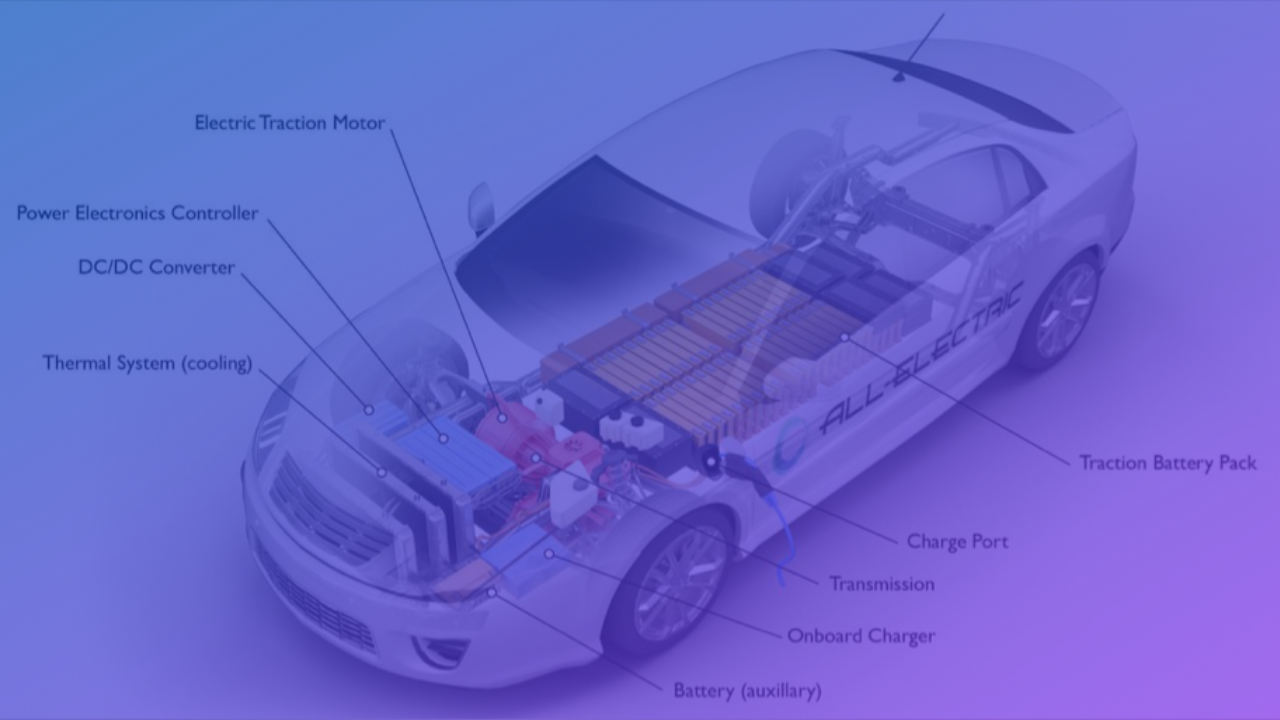

BEV does not use the Internal Combustion Engine (ICE) but uses an electric motor to run the wheels. The main components of BEV are batteries, electrical traction motors, power electronics controllers, DC/DC converters, thermal systems (cooling), onboard chargers, transmission, charger ports, and transmission battery packs.

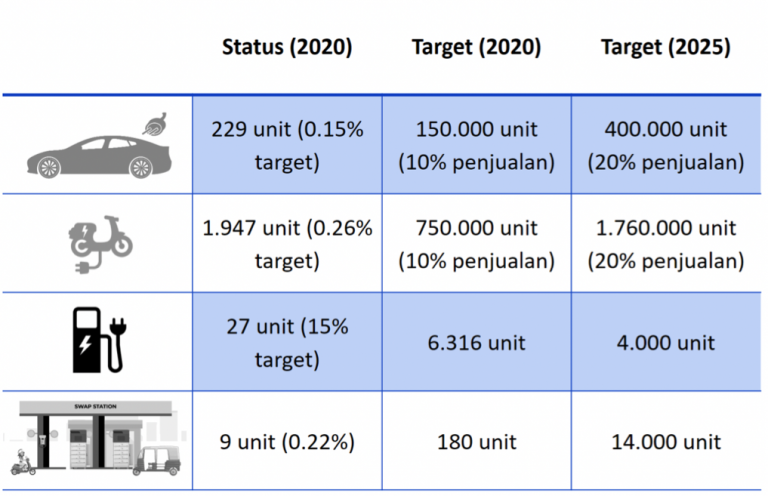

BEV adoption in Indonesia is still low compared to the target set out in RUEN and the Ministry of Industry. The BEV adoption can be seen from the distribution of vehicles operating in Indonesia.

The Adoption of BEV Globally

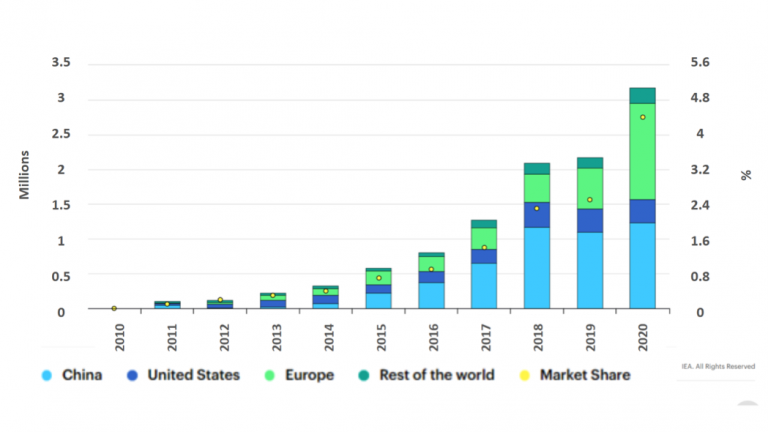

Based on a report from the International Energy Agency (IEA), BEV has experienced a rapid increase in the past nine years, from 0.1 percent market share in 2011 to 4.4 percent in 2020 or the equivalent of 3.2 million units of BEV in the world. The COVID-19 pandemic in 2020 is affecting global BEVs, resulting in a contraction of car sales by 15 percent compared to 2019. However, this condition is different from the increasing sales of BEVs. The increase in BEV sales from 2019 to 2020 increased sharply, namely up to 40 percent.

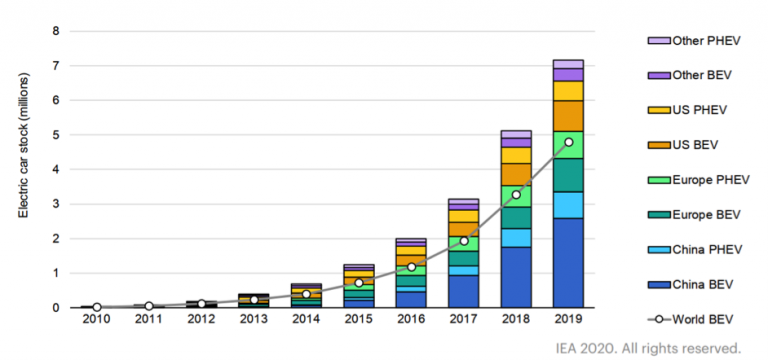

According to the IEA 2020 report, the number of BEVs has reached 7.2 million units, 47 percent of the total BEVs in the world are in China. The large market share in China has proven to attract global investors, such as Tesla, to build BEV support facilities in China.

As many as nine countries have more than 100,000 BEV units on the road. Then, as many as 20 countries worldwide achieve a market share of BEV above 1percent. World BEV sales of 2.1 million in 2019

represented a 6percent growth from the previous year. This figure is down from sales growth for the same period of at least over 30 percent since 2016.

The Statista report 2021 shows Norway occupying a 51.6 percent share of the BEV market. This indicates Norway’s highest penetration of BEVs in Europe. Norwegian BEV sales are around 141,400 units from January to December 2020. One of the most popular electric car brands in the Scandinavian country is Tesla.

Stakeholder Mapping and the Strategic Role of Indonesia Battery Corporation (IBC) in Developing BEVs

Sales of motorcycles in Indonesia continue to experience growth from year to year. Building a BEV ecosystem will increase 13.4 percent of BEV sales in 2030 or an average increase of 36 percent annually.

BEV adoption in Indonesia will not run optimum if it is carried out sectoral. A BEV adoption strategy must actively involve stakeholders who are able and willing to make specific and significant contributions, including:

1. Government, including:

1.1 The President stipulates a Presidential Regulation as a national policy related to accelerating BEV implementation.

1.2 Ministry of Finance provides an incentive facility for BEV import duties, BEV incentives are not subject to sales tax on luxury goods (PPnBM), PPh facilities through a tax allowance, namely the provision for reducing net income by 30 percent Corporate Income Tax for the total investment value for six years respectively. -Each 5 percent per year applies to the automotive industry integrated with batteries and electric motors, incentives for exemption or reduction of central and local taxes, for producers are given Super Deduction Tax and Investment Allowance facilities.

1.3 Ministry of Industry: the import duty incentives for spare parts industry, BEV accessories, import duty facilities provided for imports of machinery, goods, and materials for BEVs, obtaining government-borne import duty facilities (BMDTP) on raw and supporting materials for BEV, incentives for BEV research and development, credit assistance for the procurement of swap batteries, encouraging ICE vehicle manufacturers to produce vehicles with lower CO2 emissions, incentives for Domestic Content Levels (TKDN) so that technology transfer and domestic industrial ecosystems grow, preparing facilities for supply-chain, in collaboration with BSN in determining the BEV plug-in standard.

1.4 The Ministry of Energy and Mineral Resources stipulates fuel economy regulations, fuel quota systems, and urban policies related to fuel prices and gradually reducing fuel imports, accelerating the growth of new renewable energy, determining electricity rates for BEVs, incentive facilities for manufacturing charging equipment station, increasing the number of availability of charging stations and swapping stations in each city in Indonesia.

1.6 The Ministry of Home Affairs provides facilities for motorcycles tax incentives (PKB) and Motor Vehicle Title Fee (BBNKB).

1.7 The Indonesian National Police (POLRI) provides facilities for issuing Motorcycles Certificates, incentive facilities for cheaper parking rates for BEVs, free to pass odd-even lanes, free to pass car-free-day lanes.

1.8 The Ministry of Communication and Information Technology, providing BEV connectivity facilities through internet-based platform applications, establishes policies for platform applications for BEVs.

1.9 The National Standardization Agency for Indonesia (BSN) develops national standards for BEV, supporting components including plug-ins and batteries

1.10 The Financial Services Authority (OJK) provides incentive facilities for BEV-integrated spare parts manufacturers for a certain period.

1.11 The State Electricity Company (PLN) provides incentive facilities for BEV consumers, namely IDR 150,000 (1-phase) for additional electrical power up to 11,000 VA; IDR 450,000 (3-phase) for additional power up to 16,500 VA; and discounts 75 percent for owners of electric motorcycles. PLN provides a 30 percent discount facility for electricity usage outside of peak load (between 22:00 until 05:00) for BEV owners with home charging connected to the PLN “Charge.IN” application system.

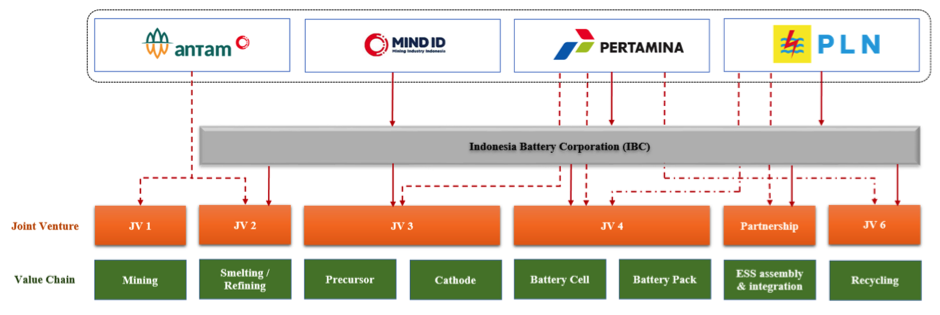

2. Industry

2.1 State-Owned Enterprises (SOE) formed a holding company, BUMN, namely Indonesia Battery Corporation (IBC), on March 16, 2021. IBC consists of four state-owned companies, namely PT Asahan Aluminum or MIND ID, its subsidiary PT Aneka Tambang Tbk (ANTM), PT Pertamina (Persero) and PT Perusahaan Listrik Negara (Persero) with a share composition of 25 percent each. IBC plays a role in managing the integrated electric vehicle battery industry ecosystem from upstream to downstream with an investment value of IDR 238 trillion.

2.2 Regional Owned Enterprises (BUMD) supports local governments to become pioneers in using BEVs for operational vehicles within the scope of their respective agencies.

2.3 Private parties, automotive manufacturers, and large fleet operators are accelerating their investment in electrification as part of their long-term commitment.

3. Academics and Research Institutions conduct research and development on BEV capabilities in line with global trends, actively develop electric motorcycle innovations, and develop batteries for fast chargers. Meanwhile, universities are developing charging station technology and developing power electronics.

4. Media conducts outreach on Government policies related to BEV.

5. The community is provided various financial service facilities for buying and selling BEVs, the availability of BEV workshops, and impacting technology, so the community is comfortable using BEV.

MIND ID and Antam are the most extensive resource players in Indonesia, with the largest nickel ore reserves globally; number one has reserves of copper, gold, aluminum, tin, and number three in coal reserves. MIND ID and Antam play an essential role in providing nickel supply as the raw material for the cathode, where the cathode is the main component of the battery. As the national oil company with the most significant production and distribution in Indonesia, Pertamina has more than 7,000 public fueling stations (SPBU) throughout Indonesia. Pertamina plays an essential role in providing precursors and cathodes, battery cells for packaging, energy storage systems (ESS) battery, and charging for BEV. PLN, as a national electricity generation and distribution company, plays an essential role in providing charging station facilities for BEVs, packaged battery cells, ESS batteries, and as an integrator of the electricity management system (EMS).

IBC has a strategic role in managing the BEV battery industry value-chain ecosystem from upstream to downstream with an investment value of US$ 17 billion until 2030 with battery production of around 140 Giga-Watt-hour (GWh) and 50 GWh of which will be exported. Meanwhile, 90 GWh is used for the production of Electric Vehicles (EV) in Indonesia. IBC was formed to become a global nickel sulfate (as a battery component) producer with an annual production

of 50,000-100,000 tonnes to serve global export and domestic demand. IBC leverages the upstream industry to build a robust intermediate value chain and downstream, becomes a global precursor and cathode producer with an annual output of 120,000-240,000 tones for export and use domestically as well as a regional player in battery cells and also a manufacturing hub for EVs in Southeast Asia.

The strategic role of IBC will also cooperate with third parties who master the technology of processing battery raw materials into batteries; this third party also controls the global market. In this case, IBC will form strategic alliances to form Joint Ventures along the BEV industry value chain from nickel ore processing, precursor, and cathode materials, to battery cells, battery packs, ESS, and recycling by vertical integration.

On May 6, 2021, IBC signed a Heads of Agreement (HoA) to invest in a BEV factory with a battery consortium, namely LG from South Korea. The consortium consists of LG Energy Solution, LG Chem, LG International, POSCO, and Huayou Holding. The HoA signing indicates that the BEV construction project will begin soon.

CATL has stated readiness and willingness with a capital of US$ 5 billion and LG Chem reaching US$ 13 – 17 billion. IBC is still open to partnering with other battery players, such as those from the United States and Japan.