Startups can be built by externally funding or self-funded, using the CEO’s money, for example.

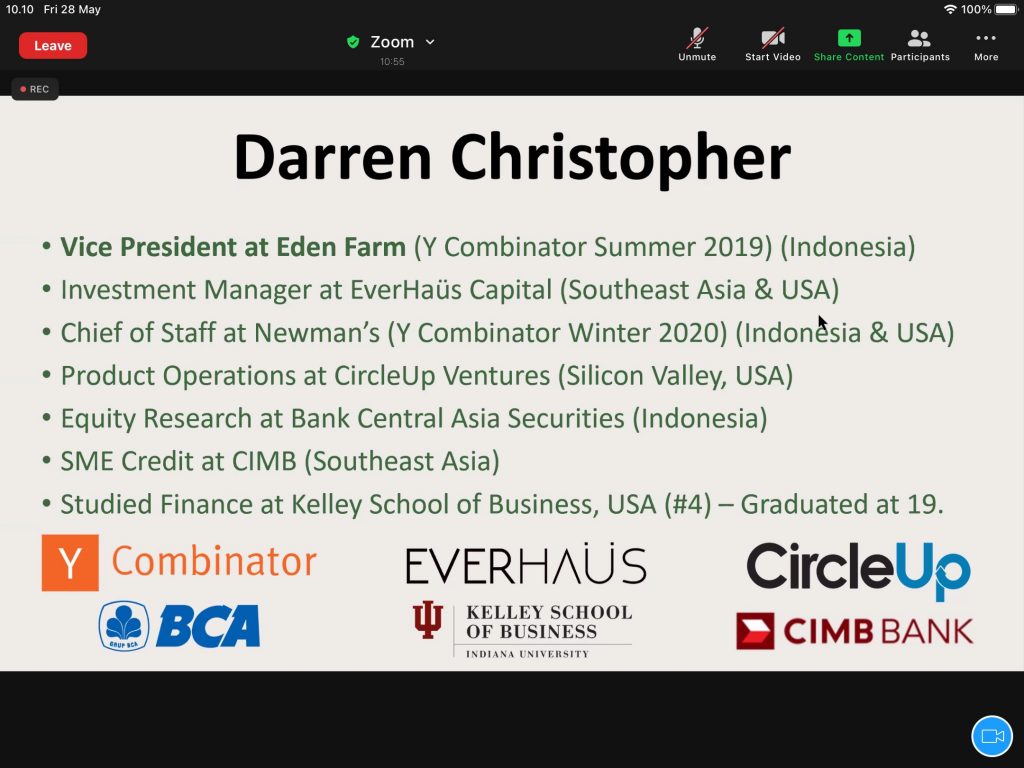

“You don’t always need to seek funding,” said Darren Christopher, the Vice President of Eden Farm on the Greater Hub Incubation Program Batch X x Fridaypreneurship.

Eden Farm is one of the fastest-growing agri-tech startups supplying all kinds of food ingredients to culinary businesses in major cities and working with local producers across the country. Darren graduated at 19 with a Finance degree at Kelley School of Business USA and became an investment manager at EverHaus Capital.

Eden Farm is one of the fastest-growing agri-tech startups supplying all kinds of food ingredients to culinary businesses in major cities and working with local producers across the country. Darren graduated at 19 with a Finance degree at Kelley School of Business USA and became an investment manager at EverHaus Capital.

However, for those who need funding from external parties, Darren has summed up three types of funding that startups can pursue: pure equity, convertible bond, and venture debt.

During the process, Darren proposes some tips to prepare for the equity round. There are preferred shares, pre-money valuation, post-money valuation, rights of first refusal, co-sale provision/tag along with rights, liquidation preference, employee stock option plan (ESOP), and put option. These numbers will later be the calculation for the exit amount from the return of investments. From EverHaus’s perspective, up to the $12.000.000 conversion threshold, the investor will stay as preferred and utilize their liquidation preference. This is an illusion of down-side protection for the investor, which is why liquidation preference exists.

Different from the equity round, few things should also be considered and prepared before the convertible debt, namely: interest rate, maturity rate, qualified financing & discount, and also valuation cap. Darren also added up that debt could turn to equity when it comes to maturity in typically 24 months (with interest), the lesser of qualified financing discount (investment threshold required to trigger the Automatic Conversion of the convertible note into equity), or the lesser of valuation cap (the maximum price that the convertible security will convert into equity).

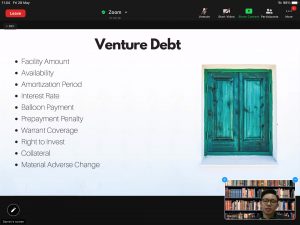

Lastly, Darren also listed the items that startups should prepare beforehand for the venture debt, including facility amount, availability, amortization period, interest rate, balloon payment, prepayment penalty, warrant coverage, right to invest, collateral, and material adverse change.

Written by Student Reporter (Tjia Alphani, Entrepreneurship 2022)