Investing in stocks can be risky, but analysis can minimize the risk. Investors and traders must analyze the stocks to purchase in advance to maximize capital gain and reduce the risk.

Nadang Kuswara, a capital market practitioner, explained some analysis that can be done by an investor and trader in choosing and purchasing stocks through a guest lecture session in MBA Jakarta, SBM ITB, Wednesday, (1/9/2021).

Nadang Kuswara, a capital market practitioner, explained some analysis that can be done by an investor and trader in choosing and purchasing stocks through a guest lecture session in MBA Jakarta, SBM ITB, Wednesday, (1/9/2021).

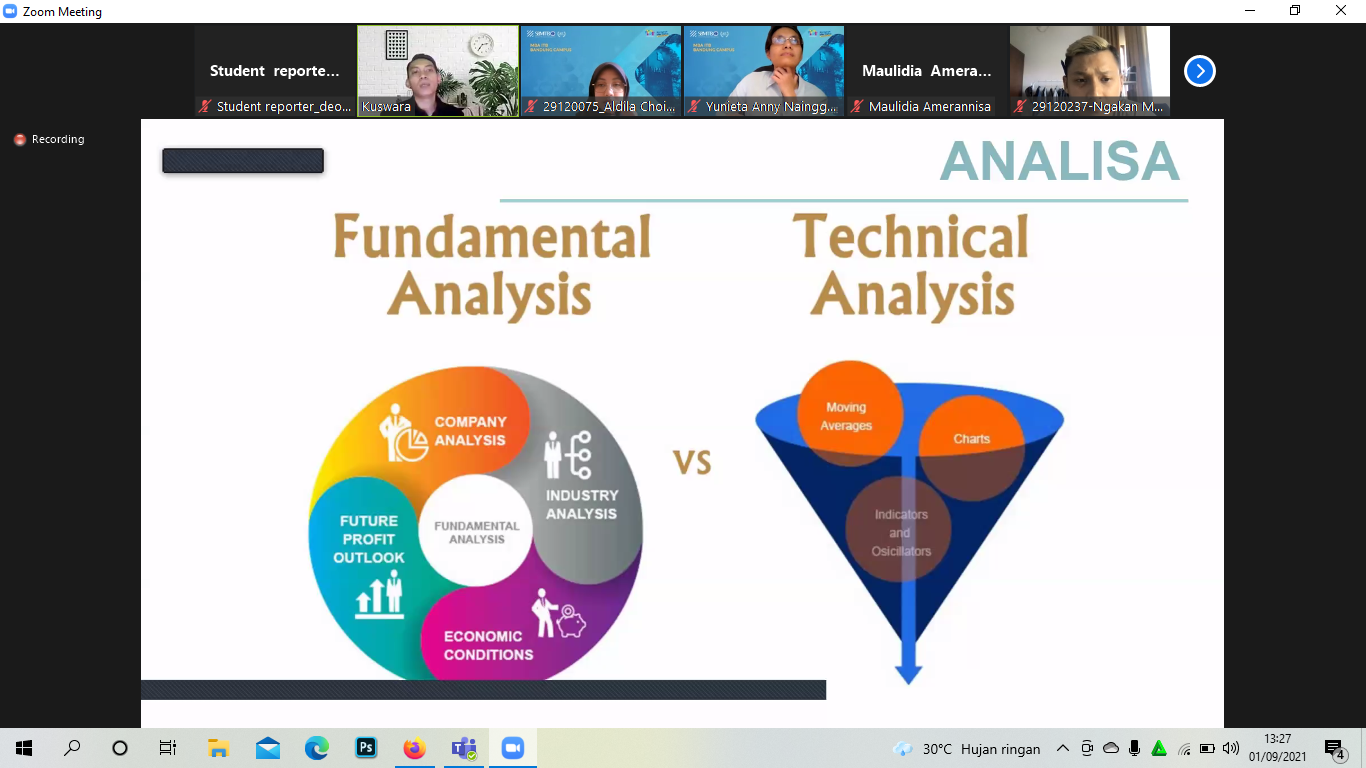

“Analyzing is critical before purchasing stocks so that we are not in the wrong position,” highlights Kuswara. He then revealed two types of analysis generally used before purchasing stocks: fundamental and technical analysis.

According to Kuswara, fundamental analysis can be defined as an analysis used to evaluate the company and forecast the external situation for the next few years by analyzing the company profile, industry, economic situation, and future profit prospects. This fundamental analysis is important before purchasing stocks. “Fundamental analysis is like a goalkeeper, so we must know fundamentally what we are going to buy,” stated Kuswara, who is also the CFO of PT Immunotech.

In his presentation, Kuswara explained an example of how people can do a fundamental analysis before purchasing stocks. “Like this Covid-19 situation, we may predict that companies in the healthcare industry will be prospective in the future because of the high demand for equipment and medical service,” said Kuswara.

In his presentation, Kuswara explained an example of how people can do a fundamental analysis before purchasing stocks. “Like this Covid-19 situation, we may predict that companies in the healthcare industry will be prospective in the future because of the high demand for equipment and medical service,” said Kuswara.

After analyzing fundamentally, we also need to analyze technically. Technical analysis is an analysis to observe the movement of the stock through statistical tools, such as graphics and math formulas. Kuswara revealed that, through technical analysis, people could calculate the profit, loss, and risk of the stock, “Technical analysis is calculating profit, risk, and loss,” said Kuswara.

Kuswara emphasized that, in technical analysis, investors and traders should do risk analysis in advance, showing how big the risk that they would bear in purchasing stocks. Next is estimating the losses and profits.

Besides fundamental and technical analysis, it is also vital to have the right mindset and psychology management to succeed in the stock market. Lastly, Kuswara said that money management is also essential, so he asked all investors and traders to diversify their stocks in different industries to minimize the risk. “Don’t put all eggs in the same basket,” Kuswara said.