SBM ITB together with the Financial Services Authority (OJK), held a seminar on the Islamic Capital Market on Saturday (5/11/2022). Several figures were present as speakers, such as the Director of OJK Sharia Capital Market, Fadilah Kartikasasi SE, MBA, the Director of the Islamic Business and Finance Center (CIBF) of SBM ITB Oktofa Yudha Sudrajad, and the Head of the Department of Sharia Capital Market Information and the OJK Institutional Relations Dyah Mustika.

When opening the seminar, the Acting Dean of SBM ITB, Prof. Dr. Jaka Sembiring, stated that Indonesia has the potential to become a country with a strong Islamic capital market. He believed the Islamic capital market has the potential to grow globally.

According to Fadilah Kartikasari, increasing public financial literacy can help spread awareness about the Islamic capital market. She stressed the importance of investing and looking forward to campuses in Indonesia to encourage understanding of financial products.

This activity is important to increase knowledge and understanding of the Islamic capital market, especially among universities. The OJK literacy and inclusion index in 2021 significantly increased compared to the 2016 survey results.

Regarding Islamic capital market literacy on campus, the Director of CIBF, Oktofa Yudha Sudrajad, said that there is a group of experts and study programs that focus on Islamic finance at the MBA ITB school. Many researchers are also interested in the topic of Islamic finance.

He also said that Islamic finance could also develop domestically and globally. Currently, Malaysia is relatively advanced in Islamic finance in Southeast Asia.

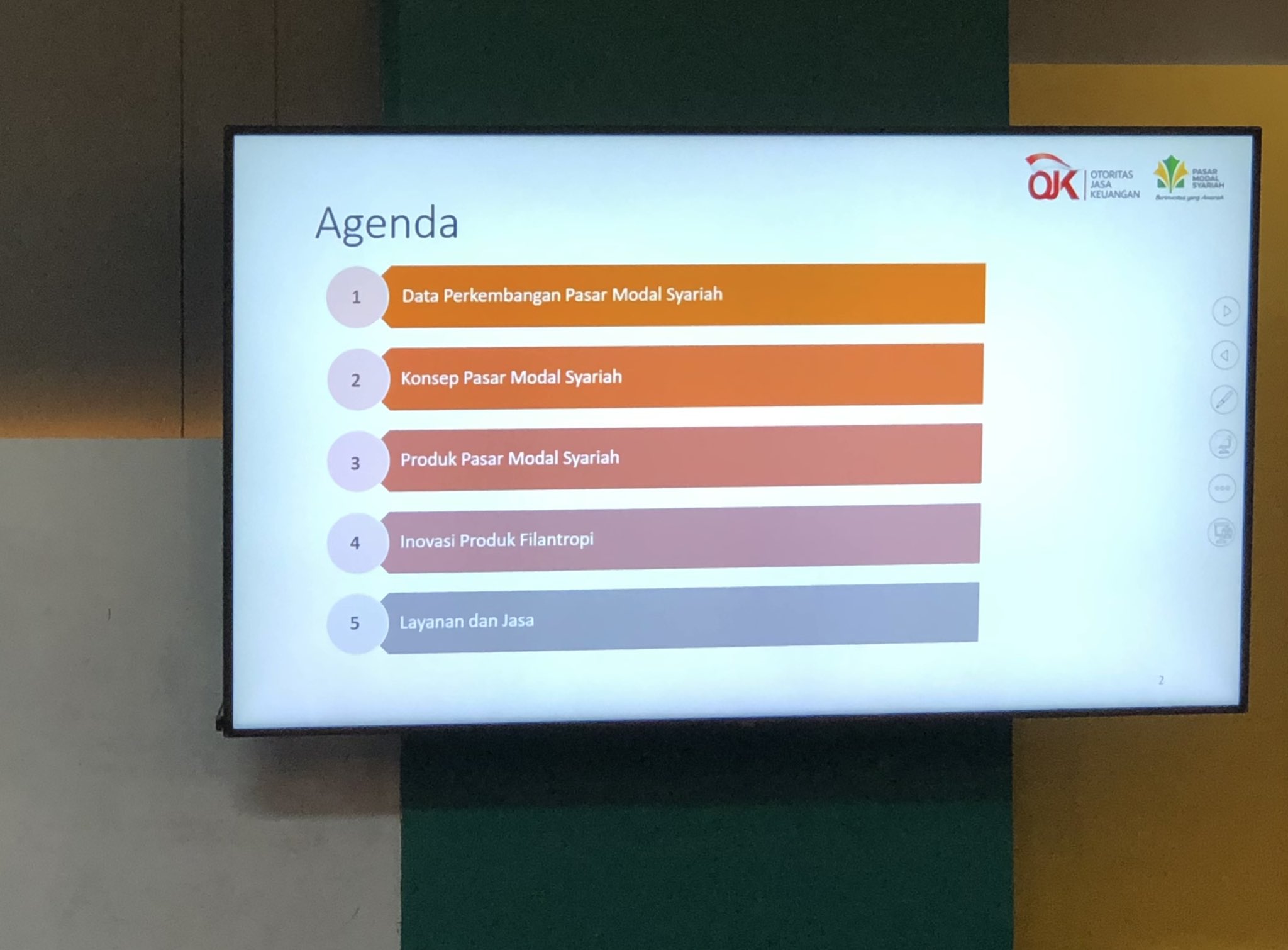

Meanwhile, according to Dyah, sharia shares, cooperative Sukuk, and sharia mutual funds have been regulated by the OJK. Currently, 45.96% of sharia shares are traded and listed on the Indonesia Stock Exchange.

Before the pandemic, sharia shares were small, less than 5%. The concept of the Islamic capital market is the concept of muamalah. Currently, the potential for developing sharia shares in Indonesia is promising. However, Islamic stocks must pass the screening first.

In Islamic finance, if we want to invest our money, it must be regulated by an investment manager. Investment managers will invest the money we have into Islamic financial products. In addition, investment activities in Islamic financial products follow sharia rules that oversee capital market activities.